The Internal Revenue Service is considering a major rollback of its language-access services, including translated forms, multilingual phone support, and live interpreter assistance. The move comes as the Trump administration pushes to make English the official language of all federal government operations.

A March 1, 2025, executive order signed by President Donald Trump directs all federal agencies, including the IRS, to assess and potentially eliminate multilingual offerings, unless deemed “essential to national security, public safety, or law enforcement.”

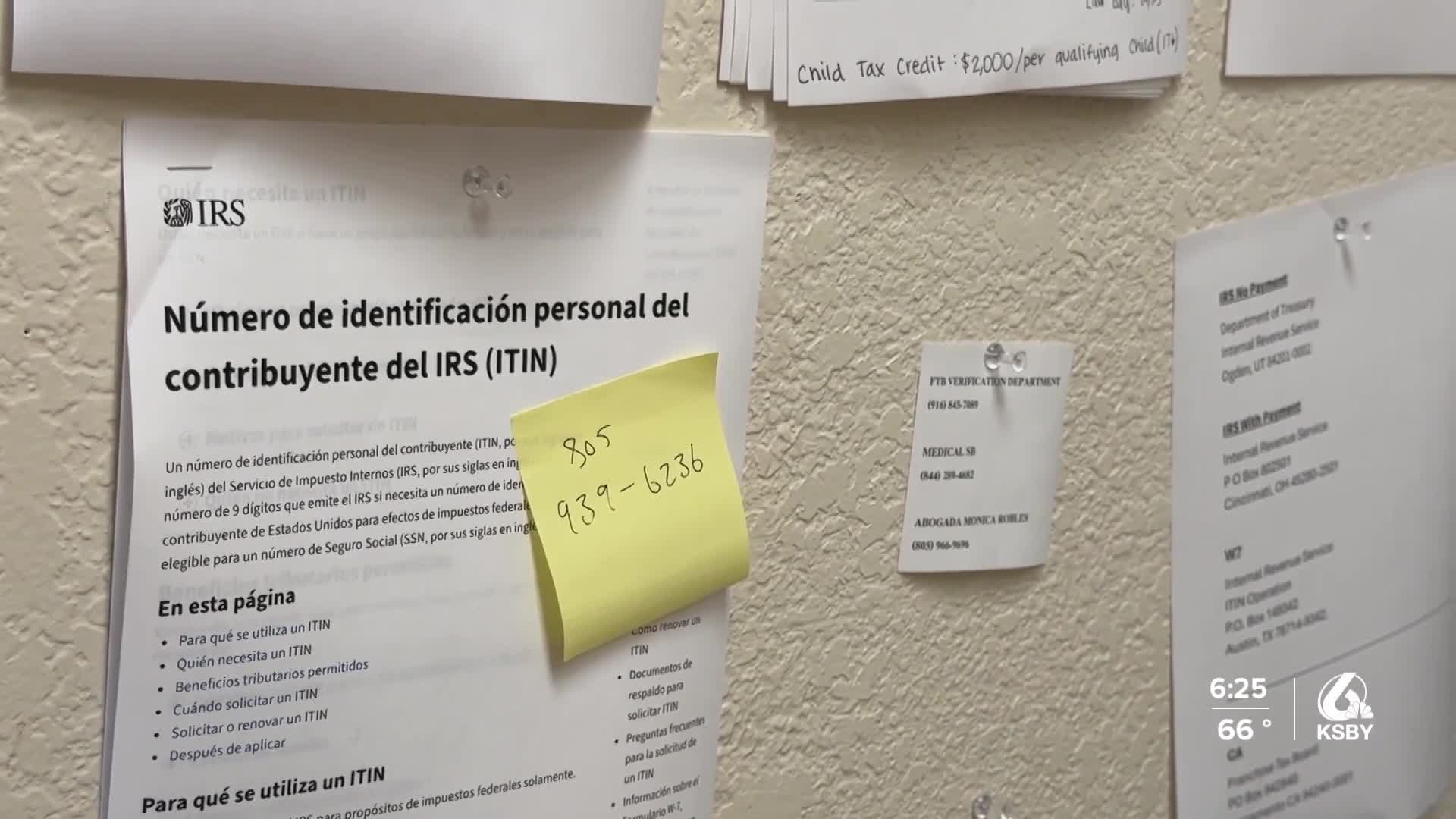

The IRS, which currently offers tax services in over six languages, is now conducting an internal review. While no formal decision has been announced, tax preparers and residents in Santa Maria say even the possibility is already creating stress.

Eliseo Ortiz, a tax preparer and manager at a local filing service in Santa Maria, says the impact is already visible.

“They would call me beforehand to just to ask if this information would be shared with anyone else outside of the IRS. And a lot of folks were waiting for last-minute filing, you know, just because of the whole thing that’s going on right now.”

Ortiz says much of that nervousness stems from fears around immigration enforcement.

“The fear is that they don’t want their personal information to be shared with ICE agents.”

Ortiz continued, “The fear is that, you know, when we filed these tax returns, there’s personal information such as, names, personal address, phone numbers, dependents. And the fear is that if this information is to share with, you know, ICE, the Department of ICE, they could possibly be vulnerable to potential arrest or deportation as well.”

When asked whether he had ever witnessed such a situation directly, Ortiz responded, “According to my personal knowledge, not that I know of, no. So my answer is no to that one.”

The IRS currently provides interpreter hotlines and has dedicated phone lines for Spanish speakers seeking tax help. Ortiz says those tools play a critical role.

“The Spanish definitely helps us significantly just because a lot of our tax clients, they come to us, they come because we speak Spanish, we speak their language,” he said. “And one of the things that IRS offers currently is the availability to speak their own language, with the agent, which is in this case, the majority Spanish.”

He says clients often need to speak directly with the IRS to solve issues that go beyond his role as a preparer.

“They can answer their questions. There’s problems that they need to resolve,” Ortiz said. “Sometimes there’s delays going on. There’s a missing document. There’s just maybe just even questions and they, they call the IRS and there’s Spanish lines, multiple lines to their own language. And that helps them as well to know that the answers to their questions, sometimes it’s not enough from us as the preparers.”

Ortiz added that his office helps clients navigate the system, but there’s only so much they can do.

“Sometimes we assist them, we call the IRS with them, where we, we just help them because there’s the whole you got to click the numbers,” he said. “We do assist them in that. But it does help significantly for the IRS to communicate directly to the client versus us as the preparers. As much as we can explain it, as much as we feel comfortable with explaining it, sometimes it just helps even more for the clients to hear directly from the agent.”

If those services are removed, he warns, the consequences could be widespread.

“If that were to happen, it’ll definitely, you know, cause a setback on a lot of filing,” Ortiz said. “A lot of people won’t be able to communicate with the IRS. It’s not going to help the community.”

When asked what advice he would give clients in the event Spanish-language IRS support disappears, Ortiz offered a few options.

“In the event that this would happen, that there’s no more, you know, multi-language services being provided, is that they would have to consult with their tax preparer,” he said. “They can call and the, the preparer can be a third party to the call. Basically, what the IRS wants is they just need to hear, you know, consent from the other party.”

“But again, I’m not exactly sure how that would work out,” he added. “Just because when we do call with our clients, they want to hear, they want to make those questions directly to the client and verify their information before they can even talk to us as the professionals here.”

Ortiz said others may turn to family members or hire interpreters.

“They would probably talk to a family member that can speak the language, that can be their interpreter to help them talk to the IRS. Or they can hire an interpreter service to call with the IRS.”

He also said the number of clients walking through his doors has declined.

“One client that came to me and she’s been my, one of my good clients that always visits me. And I remember she came and she said that all she does is go to work, go home, go get her basic needs, you know, such as food, water and go home. And that’s all she does. She came to me just because she got a letter from the IRS.”

Ortiz says filing taxes is not only a legal obligation, it’s a way to practice your right.

“I do want to just go back to the IRS code where it states that regardless of status, regardless of immigration status, if you’re working the United States and you’re making your earning income in the United States, you’re subject to taxes, you got to report that income,” he said. “So they have to file taxes. That is cooperating with the law with the United States. So I would suggest if they can, if they are able to and they have the means [of] transportation, the recommendation would be to file taxes.”

For Mayeli Munguía, a local student, the removal of Spanish-language services would put even more pressure on young people like her who already help their families with complex documents.

“It makes me feel not that great about it, because there are a lot of, places, like, especially in schools,” she said. “I know a lot of friends where their primary language is Spanish, and they still need help understanding English.”

“If they take away the services, I think they might end up taking away those classes, trying to help them better their education,” she added. “But as well as, like my parents, they mainly speak Spanish. It could impact them when they’re trying to, like, work on their things. Like with taxes, financial rules, even like getting a house because there would be a language barrier there.”

“Like, America is a very diverse place. It’s all right if they want to establish like a primary language, but they shouldn’t remove all help for any other language besides that,” she said.

She often steps in to support her parents.

“They come in handy, especially if you’re able to help out your parents in some way. And it just makes it easier,” she said. “Sometimes I do have to end up translating for them, and it’s like if they remove that, it’s just going to cause more complications along the way.”

Tess Blake, a retired ESL teacher in Santa Maria, offered a different kind of insight, based on decades of working with English learners.

“If we go to a foreign country, they always help us with our language. If we don’t understand it. And why should we eliminate all the other languages except English? That’s ridiculous. Absolutely ridiculous.”

Blake said her students were hardworking and dedicated.

“For many years, I taught English as a second language, and, my students were hard workers,” she said. “They were people coming from foreign countries, looking for opportunity, wanting to live in this country, make their lives here. And they work very, very hard learning languages and worked very, very hard for the industry in this country.”

One community member interviewed for this story supported the proposed changes, stating that the United States should have an official language and that people should learn English if they plan to live here. They declined to provide their name or go on camera.

As of now, the IRS has not formally announced whether Spanish-language tax services will be removed. But for many in Santa Maria, where nearly 79 percent of the population identifies as Hispanic or Latino and more than 60 percent of households speak Spanish at home, the potential loss is already being felt.