Earlier this month, President Donald Trump called on the credit card industry to cap interest rates at 10% and gave companies until Jan. 20 to comply.

A recent Vanderbilt University study found Trump’s proposal could save Americans $100 billion in one year.

RELATED STORY | Trump to address housing costs, credit card rates at economic summit

"I think the people that are paying 28% interest should be protected," Trump said. "We're talking about for a one-year period."

"Let the people have a break," he added.

Major banks, however, have opposed the president’s demand. JPMorgan Chase CEO Jamie Dimon has indicated that he is willing to fight the cap. Citibank has also signaled that it does not support the proposal, and Bank of America said a limit could place restrictions on who qualifies for a credit card or how much credit card holders could borrow.

RELATED STORY | Debit or credit: Which card offers better benefits for everyday purchases?

The president does not have the authority to set interest rates, and there is no clear pathway for him to compel banks to comply. The White House has not specified any consequences if banks reject the proposal.

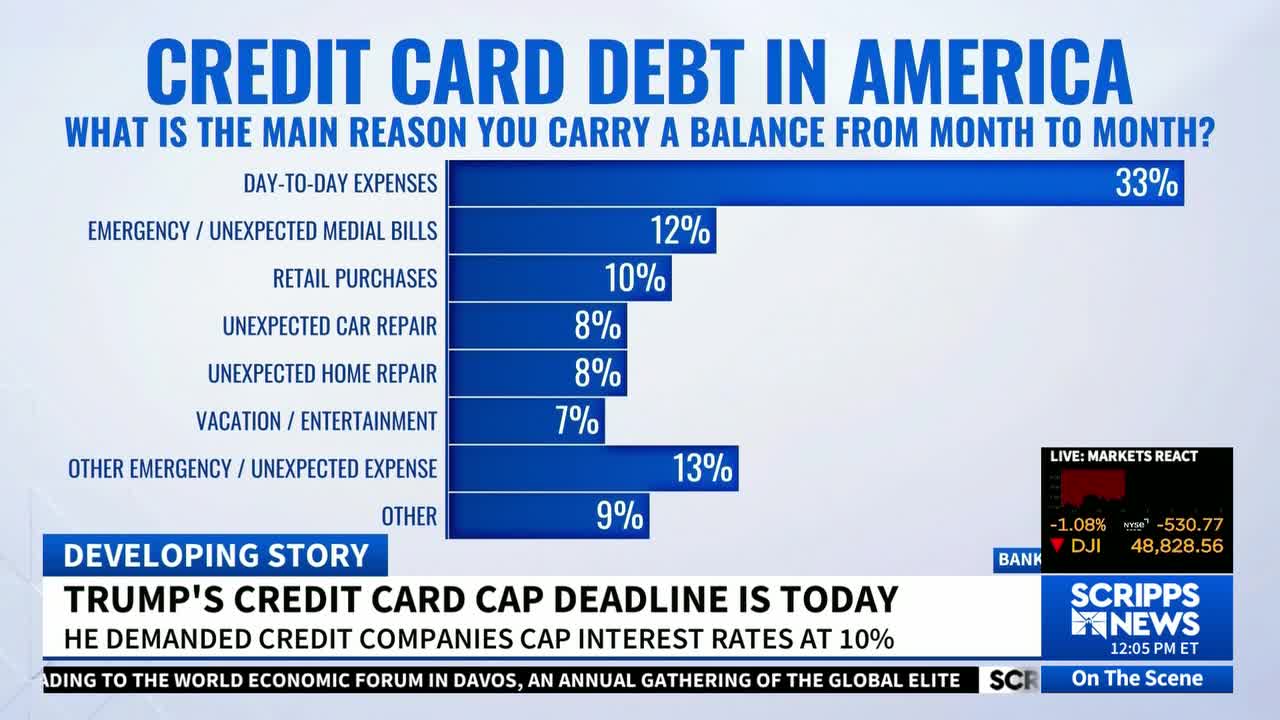

An estimated 75% to 80% of Americans have at least one credit card. Recent data also shows more people are relying on credit cards for everyday expenses, with about three in ten Americans using them regularly without paying off balances each month.

WATCH | How your credit card can get you cash back and free travel